Childcare credit for private school kids - CRA deduction?

-

flamingfingers

- Buddha of the Board

- Posts: 21666

- Joined: Jul 9th, 2005, 8:56 am

Childcare credit for private school kids - CRA deduction?

How many parents of public school kids receive a CRA tax credit for child care expenses that pertain to recesses and lunch times? None, I would guess, but look here:

Read the letter here, and don't stop there, read more:

http://www.nationalobserver.com/2016/06 ... haven-rich

SHAMELESS: The hidden private school tax haven for the rich

By Sandy Garossino in Opinion | June 22nd 2016

St. George's School for Boys, Vancouver, where tuition fees are over $20,000. Photo courtesy of St. George website.

Do you lie awake at night, trying to figure out how to make money from your own kid’s recess? Do you sometimes wonder how you can turn your non-asset-producing children into better profit centres?

There’s a knack to being rich, and not everyone has what it takes.

If you’re traumatized that your local school went on the chopping block this week, why not ensconce your child in private school, where you too can learn the secret code of money?

Take St George’s School on Vancouver’s leafy west side. So much more than just a school, “Saints” is also a taxpayer-subsidized babysitting service for boys.

When your kids are on recess break in the public school system, you hope they don’t break anything falling off the monkey bars. When they’re at Saints, you lean back and think, “Isn’t this beautiful,” while your tax gains roll in.

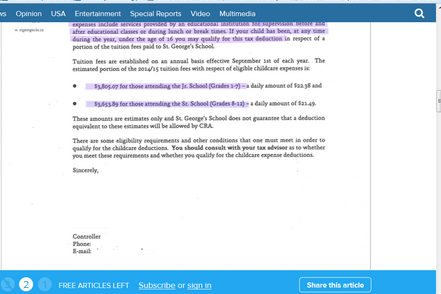

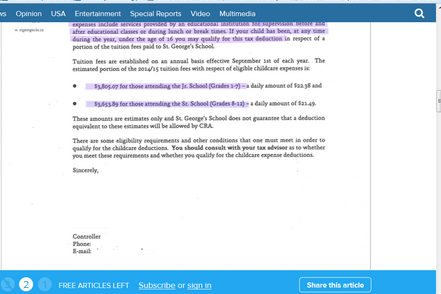

That’s because to Revenue Canada, lunch, recess and after-school activities at elite private schools aren’t education, they’re day-care. The CRA grants over $3600 in annual child-care deductions against the tuition cost of every student at St. George’s, until the age of 16.

Here’s the Saint George’s letter from 2015, showing the calculation of tax deduction on their $20,000 plus tuition:

Read the letter here, and don't stop there, read more:

http://www.nationalobserver.com/2016/06 ... haven-rich

Chill

-

Veovis

- Guru

- Posts: 7736

- Joined: Apr 19th, 2007, 3:11 pm

Re: Childcare credit for private school kids - CRA deduction

Considering teachers in BC have long argued that recess, lunch and after school activities have nothing to do with school I am wondering your argument here.

Either it is or it isn't.

I see how they managed this and it is by the standards teachers have set themselves though arguments over the years, based on those grand arguments backed by large unions ya this can be worked.

It seems a tad over the top to me, yet if it isn't school (as stated by the teachers of BC) then it is childcare, and childcare expenses have always been tax deductible. Since people in the public school system (my kids included) pay $0.00 the deduction is $0.00.

The only question I would focus on is how they get to $3,600 of $20,000 based on the hours for everything in a school year. That part I can see as a tad disproportionate.

Either it is or it isn't.

I see how they managed this and it is by the standards teachers have set themselves though arguments over the years, based on those grand arguments backed by large unions ya this can be worked.

It seems a tad over the top to me, yet if it isn't school (as stated by the teachers of BC) then it is childcare, and childcare expenses have always been tax deductible. Since people in the public school system (my kids included) pay $0.00 the deduction is $0.00.

The only question I would focus on is how they get to $3,600 of $20,000 based on the hours for everything in a school year. That part I can see as a tad disproportionate.

-

flamingfingers

- Buddha of the Board

- Posts: 21666

- Joined: Jul 9th, 2005, 8:56 am

Re: Childcare credit for private school kids - CRA deduction

^;^I think you have failed to register the fact we are talking about PRIVATE SCHOOLS; thus your 'union' comment is not valid.

Perhaps take the time to actually READ the link, OK?

Perhaps take the time to actually READ the link, OK?

Chill

- oneh2obabe

- feistres Goruchaf y Bwrdd

- Posts: 95131

- Joined: Nov 23rd, 2007, 8:19 am

Re: Childcare credit for private school kids - CRA deduction

Did you read the letter from the school saying they cannot guarantee that a deduction would be allowed by CRA and they should consult a tax advisor to see IF they qualify?

Dance as if no one's watching, sing as if no one's listening, and live everyday as if it were your last.

Life is not about waiting for the storm to pass. It's about learning to dance in the rain.

Life is not about waiting for the storm to pass. It's about learning to dance in the rain.

-

Veovis

- Guru

- Posts: 7736

- Joined: Apr 19th, 2007, 3:11 pm

Re: Childcare credit for private school kids - CRA deduction

flamingfingers wrote:^;^I think you have failed to register the fact we are talking about PRIVATE SCHOOLS; thus your 'union' comment is not valid.

Perhaps take the time to actually READ the link, OK?

I think you missed the fact that teachers backed by large unions have argued this time frames to have nothing to do with school and is therefore childcare?

I get you hate private schools, you've never been subtle about that but read what you post. There is an actual tax argument that exists for this, sure it seems off, but by teachers own arguments it creates validity.

Tax assessments and audit reassessments and a potential court case will really determine this, I know I know, you want to burn someone at the stake first and ask questions later but sadly when a potentially valid claim is made based on provincial standards of care in school and what counts as school and what doesn't......going to have to prove it wrong when teachers argue it is right.

-

LoneWolf_53

- Walks on Forum Water

- Posts: 12496

- Joined: Mar 19th, 2005, 12:06 pm

Re: Childcare credit for private school kids - CRA deduction

*removed*

Anything pertaining to education, healthcare, or Christy Clark, are met with a closed mind and predetermined position that is not open to discussion or change.

Instead of being glad, that private schools get far less money per child than public schools, hence leaving more money in the trough for her union buddies, the parents paying through the nose for educating their children, are targeted because they found a legal tax deduction.

*removed*

Anything pertaining to education, healthcare, or Christy Clark, are met with a closed mind and predetermined position that is not open to discussion or change.

Instead of being glad, that private schools get far less money per child than public schools, hence leaving more money in the trough for her union buddies, the parents paying through the nose for educating their children, are targeted because they found a legal tax deduction.

*removed*

Last edited by ferri on Jun 23rd, 2016, 6:33 am, edited 1 time in total.

Reason: off topic

Reason: off topic

"Death is life's way of saying you're fired!"

-

totoramona

- Board Meister

- Posts: 477

- Joined: Nov 21st, 2009, 6:02 pm

Re: Childcare credit for private school kids - CRA deduction

What is "shameless" is the spin on the original letter to make anyone who chooses other than the public school system BAD.

The argument is that the schooling that costs $17000 and the social times that cost $3600 are separate.

What if I choose to homeschool (doesn't cost me any money, other than the fact that I CAN'T WORK during the day and then I put my kid in other daycare activities for socializing purposes that cost me $3600 ?

And then I, (wait for it.... ) dare to use that as a deduction on my taxes....

Does that make me a greedy, penny rubbing, elitist too? Different people choose to do different things with their kids education. AND spend their money on different things. Big deal.

The argument is that the schooling that costs $17000 and the social times that cost $3600 are separate.

What if I choose to homeschool (doesn't cost me any money, other than the fact that I CAN'T WORK during the day and then I put my kid in other daycare activities for socializing purposes that cost me $3600 ?

And then I, (wait for it.... ) dare to use that as a deduction on my taxes....

Does that make me a greedy, penny rubbing, elitist too? Different people choose to do different things with their kids education. AND spend their money on different things. Big deal.

Woman jailed for sex assault

Woman jailed for sex assault Rescued after fall into river

Rescued after fall into river Killer not happy with show

Killer not happy with show Facial recognition at border?

Facial recognition at border? PM ups attacks on Poilievre

PM ups attacks on Poilievre CRA will get the money: PM

CRA will get the money: PM Instagram fraudster jailed

Instagram fraudster jailed 11 Trump allies indicted

11 Trump allies indicted Ukraine uses new missiles

Ukraine uses new missiles BoC officials split on rate cut

BoC officials split on rate cut Big loss for Boeing

Big loss for Boeing  Metro sales edged higher

Metro sales edged higher Warriors put to the brink

Warriors put to the brink Vees dominating Vipers

Vees dominating Vipers Warriors snakebitten in loss

Warriors snakebitten in loss Coachella fined $28K

Coachella fined $28K Those are her nipples

Those are her nipples Kanye to launch porn studio

Kanye to launch porn studio